Founder Magazine (FM): Leida, thank you for joining us. Can you start by telling us about your journey and what led to the creation of KORU?

Leida Correia e Silva (LCS): Thank you for having me. My journey started with a passion for solving systemic barriers Africans face in accessing finance. Millions of people are excluded from banking simply because they lack standardized identity and credit history. With KORU, we wanted to build a decentralized financial identity system that allows people to carry their creditworthiness and financial reputation across borders—what we call Africa’s Financial Passport.

FM: What is KORU’s core mission, and what problems are you trying to solve?

FM: What is KORU’s core mission, and what problems are you trying to solve?

LCS: Our mission is to create financial inclusion through decentralized identity, stablecoins, and smart wallets. The problem is not just access to banking but interoperability—Africans moving between countries or working in the diaspora cannot easily transfer their financial credibility. KORU bridges that gap, enabling smoother access to loans, payments, and cross-border transactions.

FM: How does KORU work in practice?

LCS: Users get a secure digital wallet linked to a decentralized ID. Through blockchain, we verify identity, track transaction history, and build a financial reputation that is portable. The wallet also integrates stablecoins, allowing low-cost transfers and payments—especially useful for remittances and diaspora communities.

FM: What has been your biggest milestone so far?

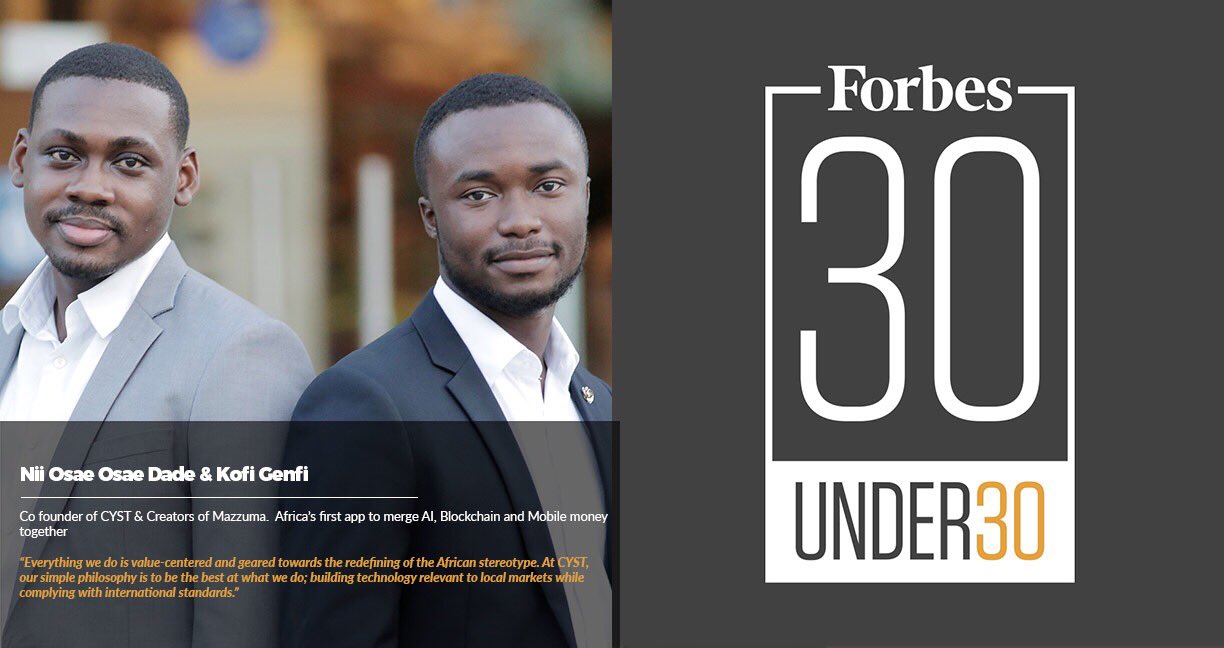

LCS: Being recognized in the Forbes Lusophone Africa 30 Under 30 (2024) list was a proud moment, not just for me personally, but for the Cape Verdean startup ecosystem. It showed that our idea resonates beyond borders. We’re also piloting KORU with SMEs and diaspora groups to refine the product.

FM: What challenges have you faced building a fintech startup in Cape Verde?

FM: What challenges have you faced building a fintech startup in Cape Verde?

LCS: The regulatory environment is still evolving, so navigating compliance in multiple countries is tough. Education and trust-building are also key—many users are new to concepts like blockchain or stablecoins. But we see this as an opportunity to build responsibly and inclusively.

FM: What’s your vision for KORU in the next five years?

LCS: We want KORU to be the go-to digital financial identity across Africa and the diaspora. Imagine a world where a student from Cape Verde can move to Portugal, Nigeria, or the U.S., and still use the same financial passport to access credit, send money, or prove financial trustworthiness. That’s the future we’re building.

FM: What advice would you give to young African founders starting out?

LCS: Don’t be afraid to tackle big problems. Africa’s challenges are opportunities in disguise. Stay persistent, build with integrity, and always keep impact at the heart of your innovation.