Founder Magazine (FM): Duke, thank you for joining us. Can you start by telling us about your background and what drew you into entrepreneurship?

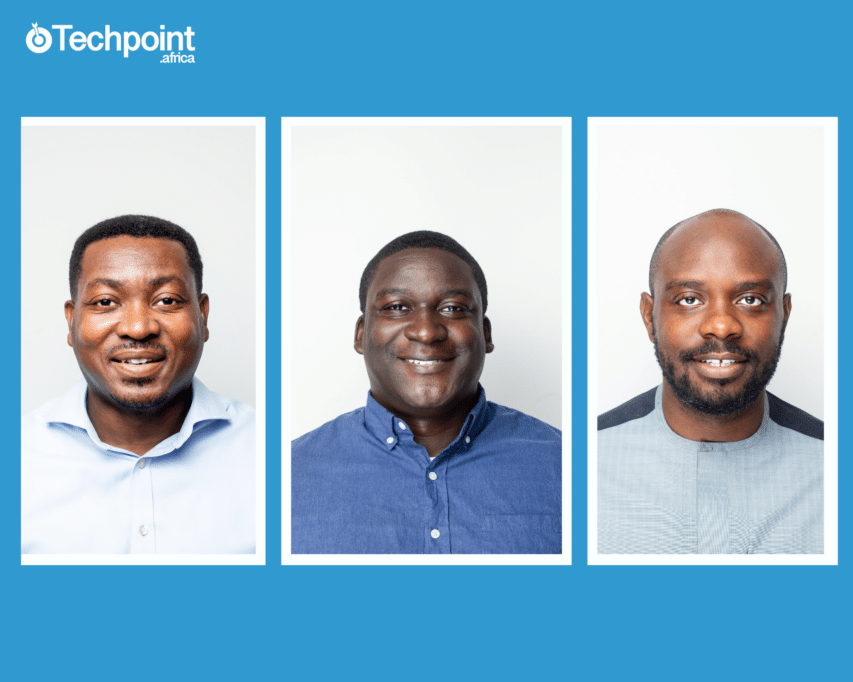

Duke Lartey (DL): Thank you. I come from a background in finance and operations. I’ve worked in both local and international financial institutions and saw firsthand the challenges that exist in African capital markets—fragmentation, low liquidity, and lack of access. When Eugene and I discussed the idea of building a platform to bridge these gaps, I immediately saw the impact it could have and decided to join him in co-founding SecondSTAX.

🚀 About SecondSTAX

FM: For readers who are new to it, what does SecondSTAX do?

DL: SecondSTAX is a fintech platform that makes it possible to access and trade securities across multiple African stock exchanges through one unified entry point. Our focus is on institutional investors and fund managers, and eventually retail investors. By integrating exchanges, we help remove barriers to cross-border investing.

FM: What’s your specific role in building the company?

DL: As COO, I focus on operations, compliance, and partnerships. In a business like ours, managing regulatory relationships and ensuring smooth execution across multiple markets is crucial. I also ensure that our internal teams work efficiently as we expand.

❓ Interview Questions (Startup & Operations Focused)

❓ Interview Questions (Startup & Operations Focused)

FM: What was the biggest challenge in operationalizing SecondSTAX across different countries?

DL: The biggest challenge is navigating multiple regulatory environments and aligning them with our technology. Each exchange and regulator has its own processes, so building trust and securing approvals takes time.

FM: How does SecondSTAX create value for investors today?

DL: We give them access, efficiency, and transparency. Instead of dealing with complex local processes in each market, they use one platform to access multiple markets seamlessly. That saves time, reduces costs, and increases opportunities.

FM: Many fintechs in Africa focus on payments and mobile money. Why did you choose capital markets instead?

DL: Because it’s an untapped area with massive potential. If Africa is to grow economically, we need strong capital markets that can attract investment. Payments are important, but capital formation is what drives long-term development.

FM: How do you and Eugene balance your roles as co-founders?

DL: Eugene drives the technology and investor-facing strategy, while I manage operations and regulatory engagement. We complement each other’s strengths well, which is why the partnership works.

FM: What’s your vision for SecondSTAX in the next five years?

DL: To become the backbone of cross-border investing in Africa—helping local and international investors tap into African growth stories.

🌍 Vision & Leadership

🌍 Vision & Leadership

FM: What do you think Africa needs most to unlock its financial markets?

DL: Two things: trust and integration. If we can build more transparent systems and harmonize regulations, Africa’s markets can compete globally.

FM: What personal values guide you as a leader?

DL: Integrity, resilience, and collaboration. Building in Africa is not easy, but if you’re committed to the mission and build strong partnerships, you can overcome challenges.

⚡ Quick Fire Questions

Favorite book? Principles by Ray Dalio.

Most inspiring African business leader? Strive Masiyiwa.

One word to describe your leadership style? Collaborative.

Advice for Ghanaian founders? Build with patience. Complex problems take time, but the impact is worth it.

✨ Closing Thoughts

FM: Duke, your work with SecondSTAX is opening up new frontiers for African finance. Thank you for sharing your journey with Founder Magazine.

DL: Thank you. I believe Africa’s financial future is bright, and I’m proud to be part of shaping it.